There is a misconception out there that a Chief Financial Officer (CFO) is a role only available to the large corporate. However, if you continue to hold this view you could be doing your business a critical disservice. Having the commercial guidance of a CFO can get your business from where you are now to where you want to be, and is one of the best investments a business owner can make.

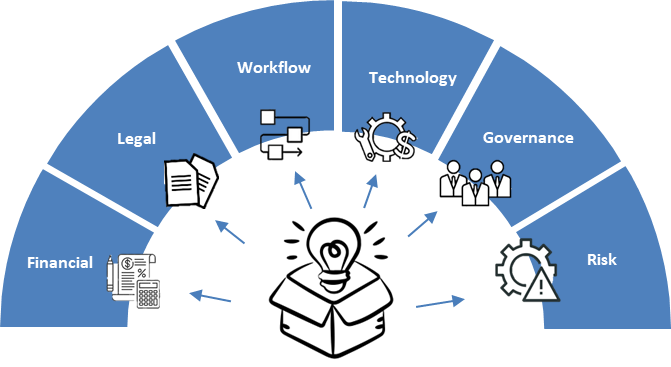

Business owners and managers often have numerous questions about their organisation’s financial performance and frequently they, or their staff, just don’t have the skills or knowledge to provide the answers. Analysing profitability, business efficiency, governance, legal guidance, capital raising needs and risk management are all areas that attract questions from business owners and managers and need answering.

When your business needs are complex, Executive Financial Services can provide guidance and assist navigating choppy waters.

Executive Financial Services

When your business needs the advice of an experienced CFO to improve financial performance, implement strategies to boost profits, rationalise costs, Executive Financial Services can assist.

With experience in small and medium sized businesses, assistance can be provided to drive financial performance, improve reporting, support organic and acquisitive growth strategies, assist with debt and equity funding solutions.

Providing a fast track to increased profitability and stand ready to step in and help you achieve long-term financial goals and success.

A CFO advisory service helps companies make wise financial decisions about a wide range of dealings and can make the difference between financial failure and success by careful observation and analysis of the needs of your business.

From optimising your budget, preparing economic forecasts to assisting with a complex transaction, Executive Financial Services can provide support to reduce costs, build your revenue and implement solutions to meet your cash flow needs.

With a hands-on approach to managing the complex needs of your business and utilising best practice fundamentals to enable positive outcomes.

Whether it is a simple transaction or a complex undertaking, we have the practical experience to deliver superior results.