Services

All organisations periodically face challenges where they require expert assistance to resolve. This can range from difficult financial reporting and accounting issues, acquisitions, funding solutions to legal matters. In certain circumstances the challenges cover broad areas.

It can often take organisations considerable time and resources to sort through these issues and how to address them, whilst getting access to a skillset that can provide guidance is generally only available to large corporations.

A good CFO does not come cheap! It is ironic that many small to medium sized enterprises (SMEs) will baulk at the kind of financial commitment to employ a CFO, but they are probably in the greatest need of their services to provide financial direction. A part-time or outsourced CFO may be the perfect solution as it offers businesses the opportunity to access their experience and expertise, but only when needed.

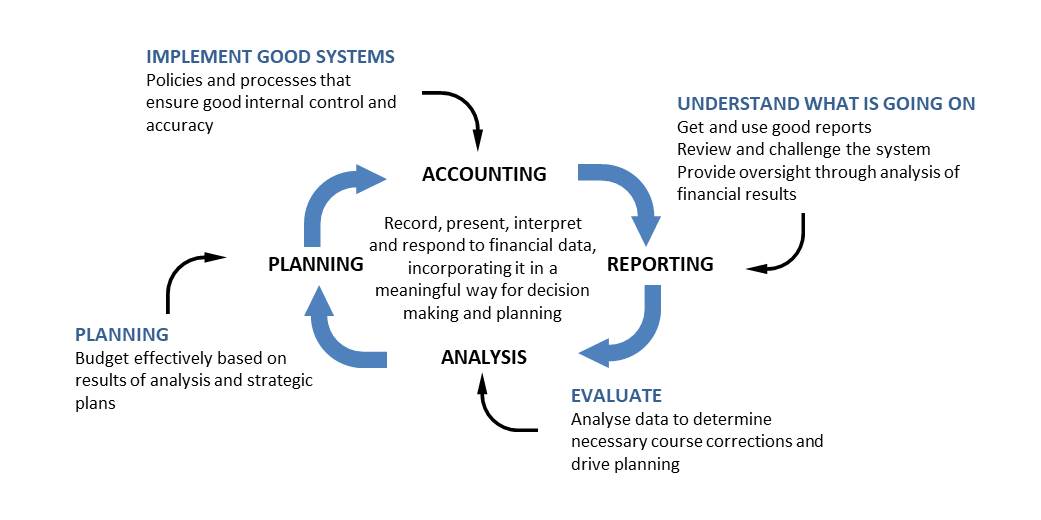

Financial management is the guiding light to the business that measures the performance and outcomes of implemented strategies.

It is critical that a business has control of its financial performance, particularly its cash flows. This includes management of its revenues and costs and ensuring that it is optimising its returns on business assets. But more importantly is setting in place the long-term strategy of the business and monitoring and reporting against targets.

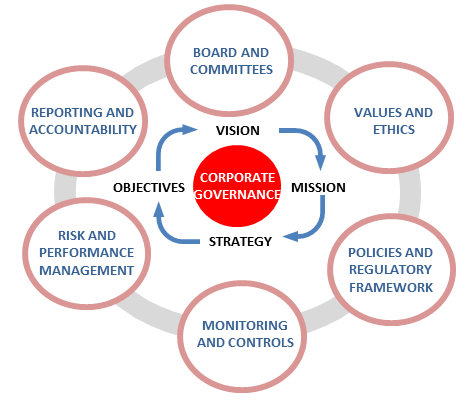

Corporate governance is more than just being responsible for maintaining the statutory obligations of a business, such as recording board minutes and ensuring compliance with laws and regulations. It is a driver of the operations and performance of a company and includes relationships between stakeholders, frameworks, decision making and responsibility.

Corporate governance encompasses the system by which an organisation is controlled and operates, and the mechanisms by which it, and its people, are held to account.

Read more

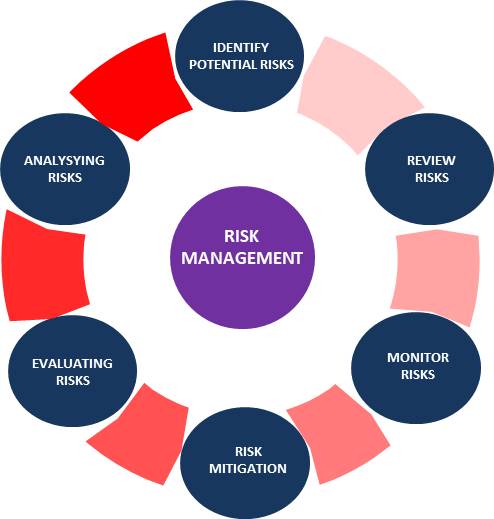

Risk management is the process of identifying, assessing and controlling financial, legal, strategic and security risks to an organisation’s capital and earnings. These threats, or risks, could stem from a wide variety of sources, including financial uncertainty, legal liabilities, strategic management errors, accidents and natural disasters.

It is critical that a business identifies risks that may materially impact its operations and implement mitigation and monitoring strategies.

Read more

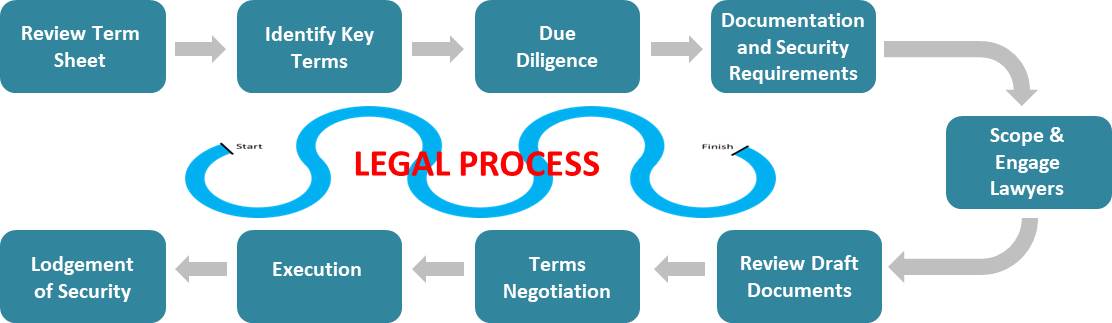

The legal needs of an organisation are not only limited to the work completed by external lawyers to resolve and assist with matters, it is also necessary to manage the process to manage any negotiation and documentation process to ensure that the expectations and needs to the organisation are met.

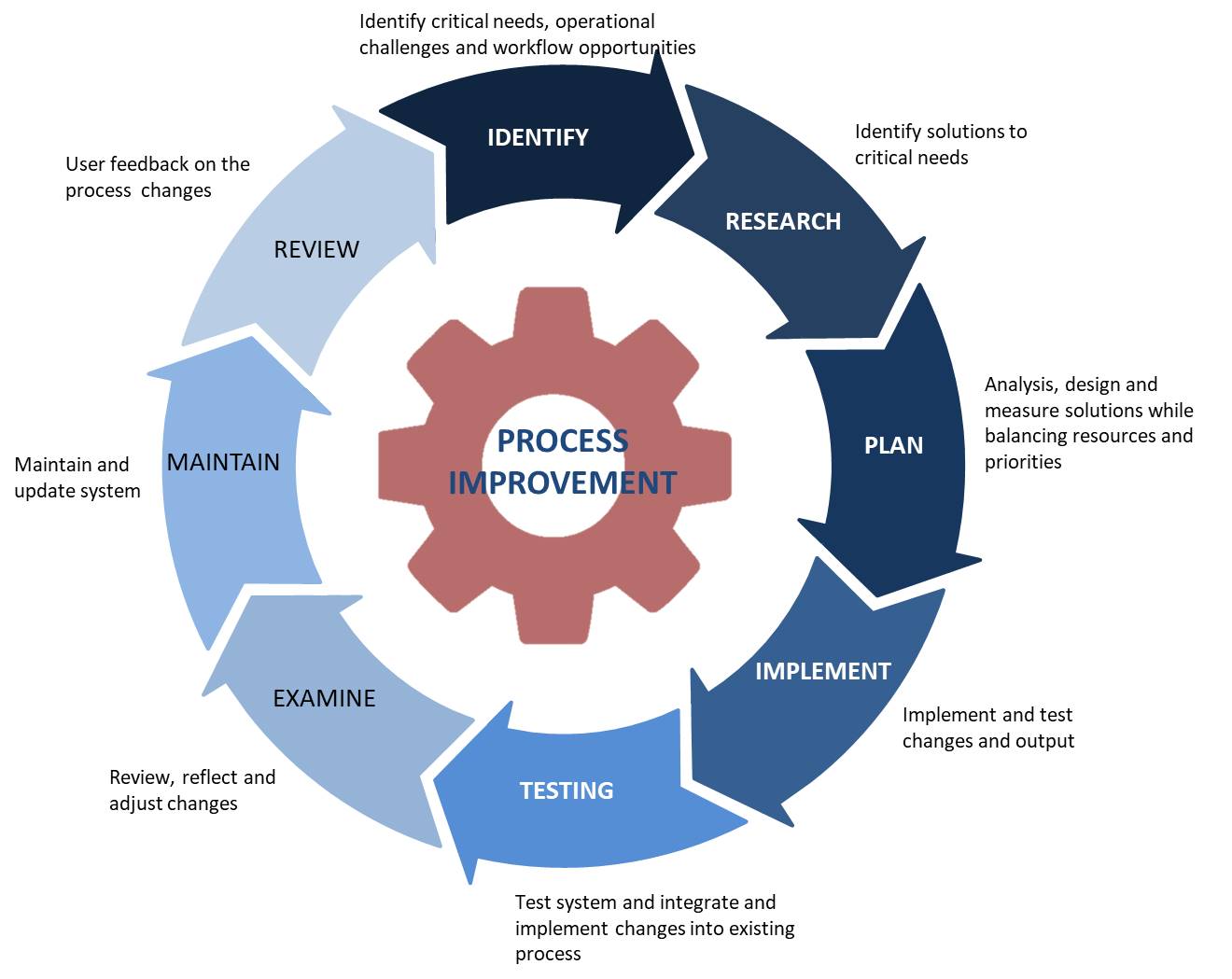

No matter how smoothly your business is operating, every business has the potential to do a little better. Or, in some cases, a lot better. Processes are established in business to keep things running or a quick work around. However, inertia and old habits can keep us following those processes even when they’re not the most effective.

The objective is to identify, analyse and improve existing processes or systems to optimise performance, processes and meet best practice standards.

Read more